- Metanet Company

-

Consulting & Managed

Metanet Global ATNS -

Application Modernization

Metanet Digital -

Infra Modernization

Metanet Tplatform rockPLACE GTPlus Utimost INS -

Solution & Service

Metanet SaaS Metanet DL Metanet Fintech -

Learning Platform

IGM Elics

-

- Service

- Product & Platform

- Careers

- About us

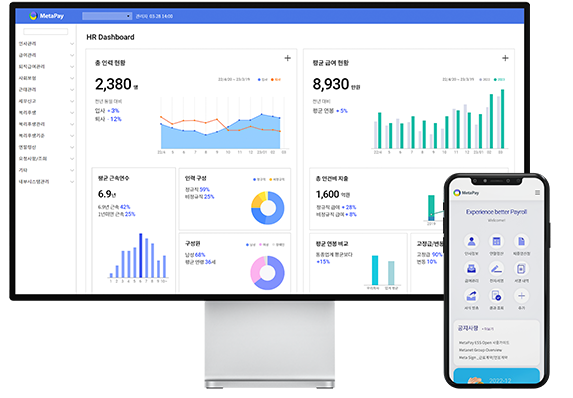

Cloud Native Payroll Solution

MetaPay is a premier Cloud Native Full Service Payroll Solution, adeptly crafted to design and deliver payroll solutions that reflect the varied roles and remuneration structures spanning businesses. Boasting a clientele of 250 from assorted sectors, it's a market frontrunner, presenting tailored service modules, robust security protocols, and seamless integration with global HR frameworks—all while alleviating payroll complexities and enhancing operational efficiency.

MetaPay Homepage ↗Value MetaPay Offers to Customers

- Reduces both the operational and system costs associated with payroll.

- Smooth integration with Global Cloud HCM and ERP.

- Provides a comprehensive solution that includes attendance and benefits.

- Continuous enhancement through advanced technologies like AI, chatbots, and OCR.

- Features a user-friendly UI/UX optimized for mobile convenience.

- Holds international security certifications ISO27001 and ISO27018, boasting a robust information security system.

Providing Basic Modules Integrated with Payroll and Extended Modules for Employee Benefits and Attendance Management.

- Payroll

-

Calculation and management of salary, bonuses, and various allowances/deductions

Generation of payroll statements

Creation of bank transfer files

- Retirement Benefits

-

Calculation of average wages and severance pay for retirees

Settlement of retirement benefits

Management of estimated severance amounts

- Four Major Insurances

-

Business establishment reporting

Reporting of acquisitions/losses of the four major insurances (EDI)

Management of deposit funds

Reporting of total compensation

- Tax (Withholding Tax)

-

Reporting of withholding taxes on salary and retirement benefits

Reporting of business/other income withholding taxes

Reporting of simplified labor income payment statements

- Personnel Information

-

Basic personnel information

Personnel dispatch management

Staff status/rosters

Certificate application/printing

- Dashboard

-

Real-time monitoring of personnel/payroll status

Data-driven forecasting and planning

Enhanced work efficiency through improved report-generation procedures

- Year-end Tax Adjustment

-

AI Bot-based year-end tax adjustment execution, with FAQ and natural language query capabilities

Upload of year-end tax adjustment PDF documents from the National Tax Service

OCR and system error verification technology

Document review and result inquiry

Supported on PC and Mobile

Generation and submission of payment statements

- Attendance (MetaTime)

-

Management of Zoom 52-hour workweek and flexible work schedules

Shift management

Attendance and annual leave management

Application/status inquiry

- Electronic Signature (MetaSign)

-

Electronic document management

Supports PDF uploads and mass mailing of internal documents such as employment/salary contracts and confidentiality agreements

- Basic module functions

- Extended module functions

- Customization features tailored to each client company

- Benefits

-

Essential core benefits (e.g., condolence payments, education expenses)

Optional benefits, application, and status inquiry

Custom system development based on client requirements

- General Affairs and Temporary Staff Management

-

Custom system development based on client requirements

Companies That Need MetaPay

- 01Companies facing complex payroll processes due to a workforce comprised of salaried employees, contractors, and temporary workers.

- 02Businesses eager to quickly build and use a system through a SaaS solution.

- 03Organizations that prefer to swiftly implement only critical functions such as payroll processing, certificate issuance, benefits, and attendance rather than a bulky ERP system.

- 04Companies requiring a payroll system with international standard security certifications to protect sensitive personal information.

- 05Enterprises looking to use a proven payroll solution.

Client References

We provide efficient services across diverse client industries, including manufacturing, IT, e-commerce, platforms, finance, and entertainment.